O'Connor discusses how administrative appeals sliced $1 billion in value from Smith County properties in 2025.

TYLER, TX, UNITED STATES, October 28, 2025 /EINPresswire.com/ -- Smith County is built around Tyler and a large network of rural towns in Texas. Much like Waco and McLennan County, Smith County acts as the big city for dozens of smaller areas, providing much-needed medical care, jobs, and resources. A lynchpin in the northeast Texas

economy, Smith County combines many classic elements of the Lone Star State into one dynamic package. Like most of Texas, the county is seeing an increase in population, construction, economic prosperity, and culture. This does have the downside of increasing property values, however, which also leads to higher taxes.Smith County depends on property taxes to fund the majority of government services. While taxes are needed to keep things running, the Smith County Appraisal District (SCAD) sometimes overvalues both homes and businesses. While exemptions are the first line of defense, property tax appeals are becoming more popular across the region and are the only way to challenge property tax bills and taxable value. The first two stages of property tax appeals, informal protests and formal hearings, are done, and can be studied to reveal the effectiveness of the process. In this article, we will explore how Smith County benefited from both types of appeals and why every taxpayer should follow suit.

Protests Lower Smith County Taxable Value by 2.6%

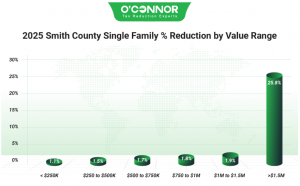

In 2024, it was estimated that 50% of all residential property in Smith County was overvalued. This is one of the reasons that protests are becoming more common in Tyler and the surrounding area. In 2025, the total value for residential property was $23.79 billion. Thanks to both informal and formal appeals, this was reduced by 2.6% to $23.17 billion. Homes worth between $250,000 and $500,000 were the largest source of value, contributing $10.68 billion to the total after a reduction of 1.5%. Homes under $250,000 were in second place with $5.31 billion, following a cut of 1.1%. Homes from $500,000 to $750,000 were protested down by 1.7%, for a new assessed figure of $4.10 billion. The largest savings by percentage were massive luxury homes worth over $1.5 million, which were reduced by a staggering 25.8%. O’Connor was able to save homeowners over 2.3% on the overall total.

The residential real estate in Smith County is quite diverse but tends to lean toward more modest homes. Following a strong cut of 3.4%, homes under 2,000 square feet totaled $11.14 billion. This was followed by homes between 2,000 and 3,999 square feet, which shrank 1.7% to $10.51 billion. Dropping 1.7% and 1.8% each, homes from 4,000 to 5,999 square feet and those from 6,000 to 7,999 square feet achieved totals of $980.18 million and $1.79 million respectively. 7.5% was knocked off luxury homes measured at over 8,000 square feet, resulting in a final sum of $356.07 million.

Most Texas counties see taxable residential value concentrated in one area of construction. Typically, this is the period from 2001 to 2020. Smith County was no exception, and $8.42 billion, or 36.3%, of all value came from this era, following a reduction of 1.7%. The remaining value was spread out quite evenly, with highlights including $5.28 billion from homes built from 1981 to 2000 and $3.86 billion from homes constructed between 1961 and 1980. These saw cuts of 1.1% and 1.5%. New construction quickly shot up the charts and was responsible for 10.2%, or $2.37 billion. This was after the final sum shrank 3.1%.

Informal and Formal Appeals Help Cut Commercial Value Down by $425 Million

While homes have been seeing record values, the same can certainly be said for businesses. In 2024, the value of businesses increased by 18%. To fight the gains from 20024 and 2025, business owners keep filing property tax appeals at high levels. In 2025, these protests were able to drop the overall value of commercial property by 4.5%, resulting in a final total of $9.06 billion, which was a decrease of $425.57 million. Smith County showed an unusual pattern in its Texas commercial property data, with most total value coming from business real estate assessed at under $500,000. Totaling $2.87 billion after a cut of 1.5%, these small businesses easily took the No. 1 spot. Business property worth over $5 million, typically the most valuable type in America, was in second place with $2.23 billion, following a huge appellant decrease of 7.7%. Real estate worth between $1 million and $5 million experienced another large drop, totaling $2.18 billion.

In a common pattern for similar urban areas surrounded by rural towns, the most important and valuable asset type was raw land. Valued at $4.44 billion, this land was able to be reduced by 1.3%, but still easily reigned atop the charts. Offices were in second place with $1.32 billion following a decrease of 6.2%. Apartments saw a huge reduction of 7.8% but still managed to stay in third place with $1.20 billion, while warehouses reached $1.13 billion after a decrease of 8.2%. Thanks to a solid drop of 7.6%, retail spaces reached a new total of $763.20 billion.

Business real estate did not quite follow the pattern set forward by homes when it came to timeframes of construction. While businesses built from 2001 to 2020 were No. 1 with $1.65 billion, this was not a run-away lead like residential properties. While a large reduction of 7.7% hit those built from 2001 to 2020, the same was not true for new construction. These business properties saw a more modest reduction of 3.4% and reached a second-place total of $1.37 billion. Those constructed from 1981 to 2000 dropped 8.3% to $1.11 billion. The largest category was raw land, classified as “other.”

Tyler and Surrounding Area Use Appeals to Lower Apartment Values by 7.8%

Apartments came in a distant third to raw land but still managed to achieve a grand total of $1.20 billion. These multifamily residences are typically the No. 1 property type in urban environments. 35.1%, or $420.05 million in value came from apartments constructed between 2001 and 2020, following an incredible decrease of 10.1%. New construction followed with $351.74 million, reflecting a decline of just 4.4%. This could reflect a growing urban influence. Those built from 1961 to 1980 and 1981 to 2000 each saw a reduction of 8.1%. Even the oldest apartments managed a big cut of 9.9%, even if they only totaled $26.48 million.

SCAD only used three categories for all apartments. General apartments and high-rises did not see any reductions and only totaled $8.33 million and $14.55 million. Garden apartments were cut by 8%, achieving a total of $1.18 billion.

Offices Manage to Shed $86.99 Million

Offices were the No. 2 commercial property in Smith County, only losing to raw land. Offices kept close to the standard mold when it came to age of construction. $422.99 million, or 32%, came from those built from 2001 to 2020, following a decrease of 3.9%. Appeals achieved a better result for offices built from 1981 to 2000, which dropped 9.3% to $381.80 million. Thanks to a solid cut of 7.1%, offices from 1961 to 1980 reached $232.24 million. New construction contributed relatively little to the total, only offering $108.09 million after a decrease of 5%.

The three subtypes of offices were more even than apartments. Following an excellent cut of 5.1%, low-rise offices reached $898.23 million. Medical offices saw the largest reduction at 9.4%, totaling $318.74 million. High-rise offices dropped 5% thanks to appeals, finishing with $103.89 million.

Appeals Grant Retail Stores a Reduction of 7.6% in Value

Retail stores lean older than most commercial property types. The biggest timeframe was still 2001 to 2020, which dropped a fantastic 8.3% to $306.15 million. Netting an even better decrease of 9.4%, stores built from 1981 to 2000 achieved a total of $205.79 million. Retail spaces from 1961 to 1980 reached a final sum of $160.66 million after a decrease of 3.8%. Even the oldest stores managed a reduction of 7.6% for a total of $70.37 million. New construction totaled $20.26 million, following a decrease of 4.9%.

Due to their versatility, SCAD divided stores into many subtypes. The most valuable were single-occupancy stores, which dropped 5.7% to $428.37 million. The ubiquitous strip center was No. 2 with $160.78 million, nabbing a fantastic value cut of 10.8%. The largest reduction by percentage was 16.1%, for neighborhood shopping centers, which led them to a new total of $50.06 million. Malls managed a decrease of 3.8%, getting a final sum of $45.25 million, while community shopping centers totaled $78.74 million.

Warehouses Dump 8.2% of Taxable Value with Protests

Out of all the property types we have covered, warehouses had the most even spread when it comes to construction dates. Thanks to a large slashing of 8.2%, the total for all warehouses dropped to $1.13 billion. Those built between 2001 and 2020 were still in the lead, but barely, reaching $336.77 million after an outstanding reduction of 9.6%. Those built from 1981 to 2000 were close behind with $304.23 million after shrinking 7%. New construction has been rocketing up the charts, finishing at $246.98 million after a cut of 6.2%. The largest reduction by percentage was for the oldest warehouses, which fell 10.7% to $59.78 million.

SCAD used three categories to classify warehouses. Office warehouses were the largest with a total of $644.29 million, achieved thanks to a drop of 7.7%. Generic warehouses nabbed a cut of 7.9%, for a sum of $350.21 million. Mini warehouses saw a huge cut of 11.4%, netting a final total of $133.70 million.

About O'Connor:

O’Connor is one of the largest property tax consulting firms, representing 185,000 clients in 49 states and Canada, handling about 295,000 protests in 2024, with residential property tax reduction services in Texas, Illinois, Georgia, and New York. O’Connor’s possesses the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs a team of 1,000 worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

No comments:

Post a Comment